Decentralised exchange, or DEX for short, appears like something complicated. However, it can be simple. In my experience, it was just me, my laptop, and my phone. No bank. No middleman. Just me swapping coins directly with someone else through the blockchain.

In Nigeria, this can be a game-changer. We know how bank limits and FX restrictions can frustrate anyone trying to trade or send money abroad. With DEXs, I don’t need permission from a bank or a central exchange. The power — and the responsibility — sits in my own hands.

Let me walk you through how I started using DEXs, what I learned along the way, and how you can do the same without falling into the common traps.

Step 1: Understand What a DEX Really Is

Before I jumped in, I wanted to understand the difference between a centralised exchange (CEX) and a decentralised exchange (DEX).

On a CEX like Binance or Luno, you open an account, verify your identity (KYC), and they hold your funds for you. It’s like depositing your money in a bank.

On a DEX like Uniswap, PancakeSwap, or 1inch, you connect your wallet and trade directly with other people’s wallets. No one holds your funds. You are your own bank.

For me, the main difference is that on a DEX, I control my private keys. If I lose them, there’s no customer support to help me recover my coins. That freedom is both exciting and scary.

Step 2: Get a Crypto Wallet That Works With DEXs

A DEX doesn’t store your coins, so you need a wallet that can connect to it. I already had Trust Wallet on my phone, but MetaMask is another popular choice.

When I opened Trust Wallet, I made sure my recovery phrase was written down safely. I wasn’t about to risk losing my funds because of a misplaced piece of paper.

I also checked which blockchain I wanted to use. For example:

- Ethereum DEXs work best with Ethereum network wallets

- BSC (Binance Smart Chain) DEXs like PancakeSwap need a BSC-compatible wallet

In Nigeria, many traders use Binance Smart Chain because transaction fees are much cheaper than Ethereum gas fees. You can consider it too.

Step 3: Fund Your Wallet

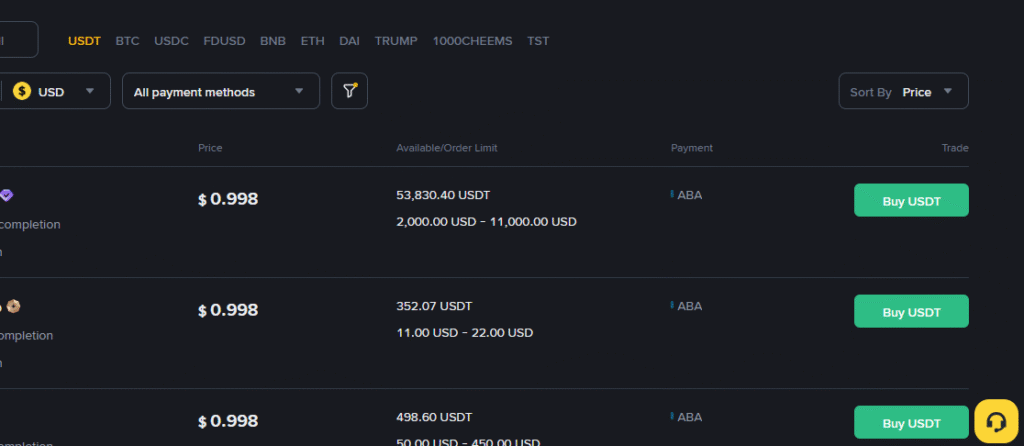

A DEX trade needs crypto in your wallet first. You can’t use naira directly. So I had to buy some coins from a CEX first (Binance in my case) using P2P.

Here’s how I did it:

- Went to Binance P2P and bought BNB from a seller using my bank transfer.

- Withdrew the BNB to my Trust Wallet address.

- Double-checked the network — I sent BNB via Binance Smart Chain (BEP-20).

The first time I did this, I was nervous. I kept refreshing my wallet until the coins appeared. However, Binance is a trusted CEX, so there’s actually no cause for alarm.

Step 4: Choose the Right DEX

Different DEXs support different blockchains. For example:

- Uniswap — Ethereum network

- PancakeSwap — Binance Smart Chain

- SushiSwap — Multi-chain (Ethereum, Polygon, etc.)

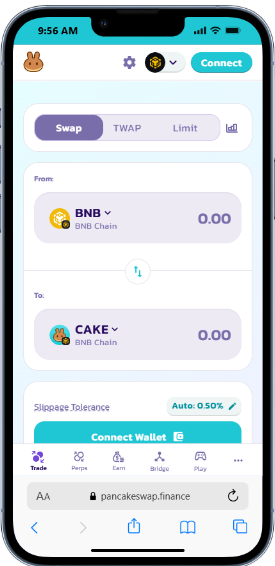

Since I had BNB, I went with PancakeSwap. I typed in “pancakeswap.finance” directly in my browser. Note that scammers can set up fake websites with similar names, so I never click random links from WhatsApp groups or Twitter.

Step 5: Connect Your Wallet

On PancakeSwap’s homepage, there’s a Connect Wallet button. I tapped it and selected Trust Wallet. My wallet app opened, asking me to confirm the connection.

This step is important, and connecting doesn’t mean giving away your coins. It just allows the DEX to read your balance and execute trades you approve.

Step 6: Make Your First Swap

Here’s where things got exciting. I decided to swap a little BNB for CAKE (PancakeSwap’s native token).

I went to the Swap page, selected BNB in the first box and CAKE in the second. I typed the amount, checked the exchange rate, and saw the network fee (gas fee) displayed.

When I clicked Swap, my wallet app popped up asking me to approve the transaction. I checked everything again — the token, the amount, and the fee — before confirming.

About ten seconds later, my wallet showed my new CAKE balance. No waiting for bank alerts. No middleman.

Step 7: Learn About Slippage

In my second trade, I hit an error. It said “Transaction failed due to price movement.” That’s when I learned about slippage tolerance.

Slippage is the price difference between when you start the trade and when it’s executed. If a token’s price is moving fast, you may need to set a higher slippage percentage (like 2% or 5%).

But high slippage can also mean risky “pump and dump” tokens. Now, I always research the token before setting slippage above 1%.

Step 8: Understand Gas Fees and Networks

I quickly found out that DEXs charge network fees for every transaction. On Ethereum, these fees can be several dollars or hundreds of naira, which is a lot when you’re trading small amounts.

That’s why I mostly use Binance Smart Chain for now. In Nigeria, where every naira counts, saving on gas fees makes a big difference.

Step 9: Avoid Scam Tokens

A friend once asked me to swap BNB for a “new hot coin” he saw on Twitter. It looked cheap, but when I tried to sell it back, I couldn’t. It was a honeypot scam, where the token’s contract allowed buying but blocked selling.

Now I always check:

- The token’s contract address from a trusted source (like CoinMarketCap)

- The token’s trading history on BscScan or Etherscan

- If there’s enough liquidity in the pool to sell later

Step 10: Withdraw or Store Safely

After trading, I either keep my coins in my Web3 wallet or send them to a cold wallet for long-term storage. If I need to sell for naira, I send the coins back to Binance and use P2P.

This flow — wallet → DEX → wallet → CEX → bank — is how many Nigerians now move money in and out of crypto without depending on direct bank deposits for every step.

My First Big Mistake

One night, I tried to trade on a DEX using my phone’s public Wi-Fi connection. The next day, strange approval requests started showing in my wallet. Luckily, I rejected them, but I learned a hard lesson: never trade on public Wi-Fi.

Now I stick to my mobile data or home internet. I also regularly revoke token approvals, so I no longer need to use sites like revoke.cash.

3 Reasons I Use DEXs

- Freedom from limits: I’ve bought tokens at 2 AM on a Sunday when banks were closed.

- Access to new tokens early: Some coins appear on DEXs weeks before they hit centralised exchanges.

- Control of funds: My coins aren’t frozen because of some policy change.

Risks I Keep in Mind

Even though I love the freedom, I know DEXs are not without danger:

- Losing private keys means losing coins forever

- Smart contract bugs could drain liquidity pools

- Scammers are always looking for the next victim

So I treat DEX trading like driving on Lagos roads. It’s exciting, but you have to stay alert.

My Personal DEX Routine

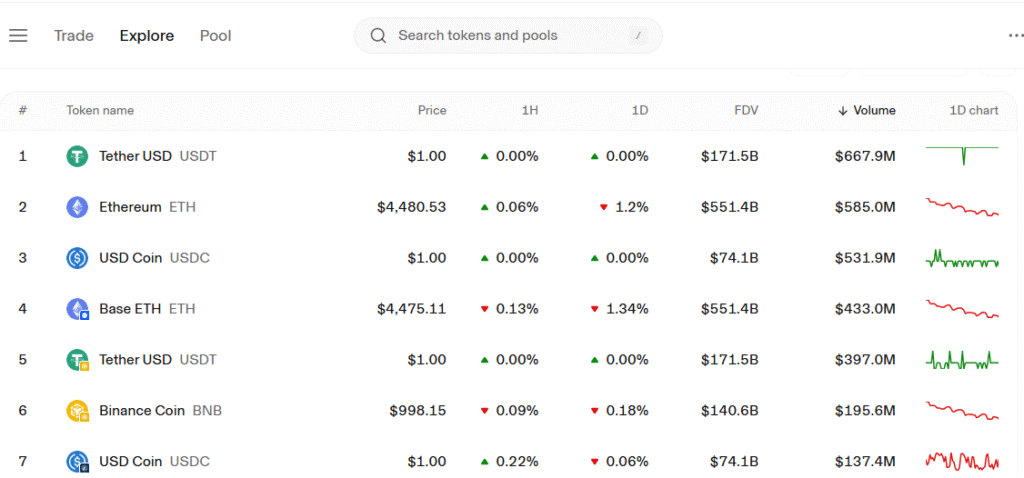

- Check the market: I look at CoinGecko or CoinMarketCap for token prices.

- Research: I check the token’s website, whitepaper, and social media.

- Small test trade: I start small and never go all in at once.

- Confirm contract address: I paste it manually to avoid fake tokens.

- Trade with correct slippage: Too high means risk, too low may fail.

- Track my trades: I note the amount, date, and purpose.

My Takeaway

With more Nigerians freelancing, trading, and working remotely, I see DEX usage growing fast. The appeal is simple: no bank queues, no third-party delays, and no “service unavailable” messages.

Still, I believe education is key. Just like I had to learn from my own small mistakes, new users need guides and communities to help them avoid losing money.