You can put your crypto in a platform, and it earns you more crypto. No banks, no paperwork, no waiting. That’s what making money in DeFi is all about. However, it’s not that simple.

In Nigeria, people jump quickly on any new money-making trend, so I’ve seen DeFi turn into both a blessing and a nightmare. People have made real money with DeFi. Some have also lost all their funds in scams that looked legit.

If you’re thinking of going into DeFi, let me walk you through how you can potentially make money while avoiding traps that can drain your wallet.

Step 1: Understand What DeFi Is

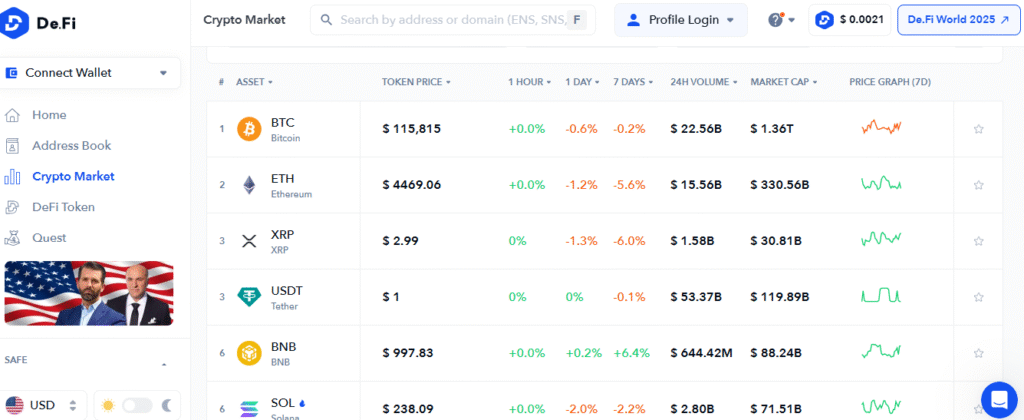

Before I put any money in, I needed to understand the basics. DeFi means Decentralised Finance — financial services built on blockchain, without banks or middlemen.

With DeFi, you can:

- Lend your crypto and earn interest

- Provide liquidity and earn fees

- Stake tokens for rewards

- Trade on decentralised exchanges (DEXs)

It’s like the financial system, but open to anyone with a crypto wallet. The sweet part? You keep control of your funds. The risky part? If you make a wrong move, there’s no customer care to call.

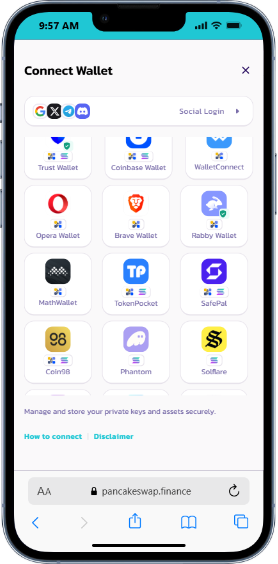

Step 2: Start with a Safe Wallet

Everything in DeFi begins with your wallet. I use MetaMask for my laptop and Trust Wallet on my phone. If you already have one, make sure you’ve written down your recovery phrase somewhere safe. It shouldn’t be in your phone’s gallery or email.

In Nigeria, phone theft is common. I’ve heard of people who lost both their phone and all their crypto because the thief got into their wallet app. That’s why I use a strong password and, where possible, biometric lock.

Step 3: Choose a Legit Platform

This is where most people get scammed. A flashy website promising 300% returns in 30 days is not DeFi: it’s a trap. Real DeFi platforms don’t promise unrealistic gains.

I stick to well-known names like:

- Aave for lending and borrowing

- Uniswap for token swaps

- PancakeSwap for BSC-based earning

- Curve for stablecoin liquidity pools

Before using any platform, I check:

- How long they’ve been operating

- If they’ve been audited by a security firm

- Their community — real projects have active Telegram or Discord groups

Step 4: Start Small with Lending or Staking

When I started, I tested the waters with lending on Aave. I deposited some USDT (a stablecoin) and earned interest. The rate wasn’t crazy high, but it was steady and safe.

Staking is another option. I staked some BNB on Binance Smart Chain through PancakeSwap and got CAKE tokens as rewards. The trick here is to pick a staking pool from a trusted project. Unknown pools with high “APY” (Annual Percentage Yield) often disappear overnight.

Step 5: Learn About Liquidity Pools Before Jumping In

Liquidity pools are one of DeFi’s biggest earning methods. You put two coins (like ETH and USDC) into a pool on a DEX, and you get a share of the trading fees.

But there’s something called impermanent loss. If one token’s price changes a lot, you could end up with fewer coins than you started with, even if you earn fees.

I learned this the hard way with a volatile token. Now, I only provide liquidity for pairs with stablecoins or well-known coins to reduce risk.

Step 6: Avoid “Rug Pull” Traps

A rug pull happens when a project’s creators drain all the liquidity from a pool, leaving the token worthless. It’s common in Nigeria’s crypto Telegram groups where someone says, “Buy this new coin before it moons!”

My rules for avoiding rug pulls:

- Check if the liquidity is locked for a period of time

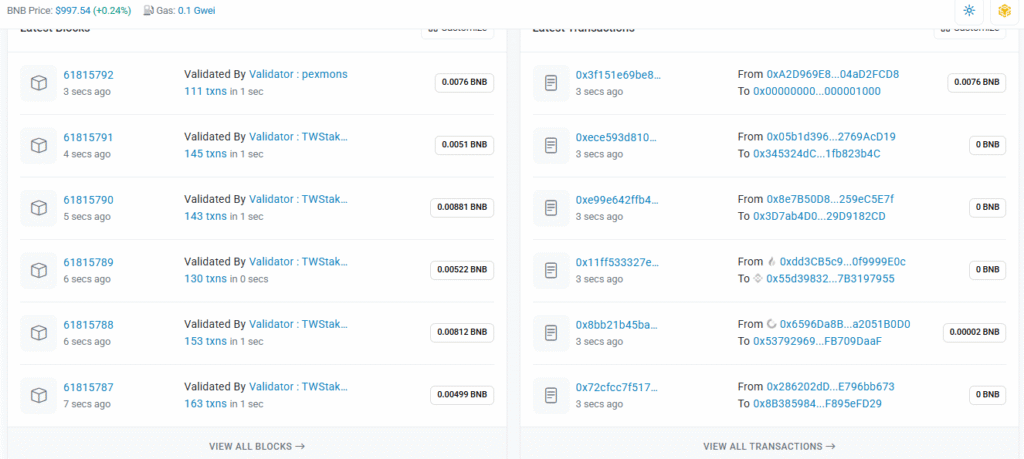

- Verify the token contract address on a site like BscScan or Etherscan

- Avoid coins with zero or suspicious trading history

Step 7: Keep Gas Fees in Mind

Some DeFi transactions cost more than they’re worth. On Ethereum, gas fees can eat half your profit if you’re not careful. That’s why I often use Binance Smart Chain, Polygon, or Arbitrum for cheaper transactions.

If a transaction is costing more than you stand to gain, it’s better to wait or use a different network.

Step 8: Watch Out for Fake Apps and Links

One of the fastest ways to lose your funds is by connecting your wallet to a fake DeFi site. I once saw a “Uniswap promo” link that looked exactly like the real site but with an extra letter in the URL.

Now, I:

- Bookmark official websites

- Get links directly from verified social media accounts

- Never click links sent by random WhatsApp or Telegram contacts

Step 9: Track Your Earnings and Withdraw Smartly

DeFi earnings can be tempting to keep rolling into new investments, but I like to secure the bag regularly. For example, if I make ₦50,000 in rewards, I might withdraw ₦20,000 and reinvest the rest.

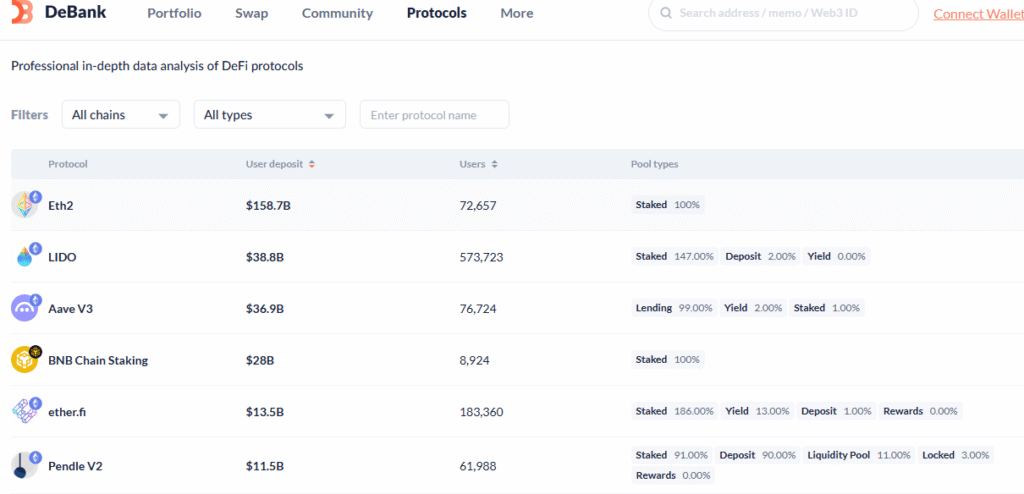

I also use portfolio trackers like Zapper or DeBank to see all my DeFi positions in one place. This keeps me from forgetting where my money is.

Step 10: Keep Learning and Stay Updated

The DeFi world moves fast. A platform that’s hot today might have a security breach tomorrow. I follow crypto news channels and join Nigerian DeFi groups where people share real-time updates.

I also test new features with small amounts first. This way, even if something goes wrong, it won’t wipe me out.

My Golden Rules for DeFi Safety

- If it sounds too good to be true, it is

- Use small amounts to test first

- Never share your seed phrase

- Stick to known platforms

- Withdraw profits regularly

- Avoid hype-driven Telegram shills

Bottom Line

Making passive income from DeFi is not just a trend, but also it’s a shift in how money works. The thing is that in Nigeria, get-rich-quick traps are everywhere. Therefore, DeFi is only safe if you mix boldness with caution.

If you’re ready to try it, start small, learn fast, and protect your wallet like you protect your ATM PIN. That way, when the profits come, they stay in your hands.